XRP Price Predictions for H2 2025 and 2026: Expert Outlook & Key Trends

Introduction: XRP’s Mid-2025 Surge and Forecast Debate

Ripple’s XRP token has seen a remarkable resurgence in 2025, recently rallying above $3 (peaking around $3.64 in mid-July) amid renewed investor optimism. As of mid-July 2025, XRP is trading around $3.55 with a market capitalization near $210 billion, making it the 3rd-largest cryptocurrency. This price represents roughly an eightfold increase from its ~$0.44 low in the past year, fueled by a confluence of positive developments. Notably, Bitcoin’s price is hovering around $120,000 (market cap ~$2.39 trillion), and a broadly bullish crypto market (total market cap ~$3.95 trillion) provides a favorable backdrop. XRP’s recent breakout above the psychological $3 level – after months of consolidation between $2.30 and $2.85 – is seen as a sign of improved investor confidence in Ripple’s enterprise vision. Whale addresses holding ≥1 million XRP are at an all-time high, indicating that “big investors are getting involved,” according to on-chain data. This context sets the stage for debates on whether XRP can sustain its momentum into late 2025 and 2026, or if growth will moderate. Below, we examine what various experts and institutions predict for XRP’s price in H2 2025 and 2026 under both bullish and cautious scenarios.

Current Market Context (Mid-2025)

As of July 18, 2025, XRP’s price surge has pushed it to year-to-date highs. XRP briefly skyrocketed ~20% in one day to ~$3.64 in mid-July, driving its market cap to around $210 billion (approaching a milestone $200B level). This solidified XRP’s position as the #3 crypto by market size. Bitcoin, meanwhile, trades around $120K per coin, after a modest uptick, with a market cap of roughly $2.39 trillion. The XRP/BTC pair is roughly 0.00003 BTC per XRP, meaning XRP has slightly gained ground against Bitcoin compared to earlier in the year. For context, during the recent rally XRP’s share of the total crypto market has risen to about 5.3% (up from ~4.4% a month prior), while Bitcoin’s dominance stands around 60–61%. The broader bullish market – aided by regulatory clarity and speculation like the launch of an XRP futures ETF – has set a favorable environment for altcoins. XRP’s sustained climb above $3 (its highest price since early 2018) underscores improved sentiment toward Ripple’s ecosystem. After years of being range-bound, XRP’s strong performance in mid-2025 has many observers reassessing their forecasts for late 2025 and 2026.

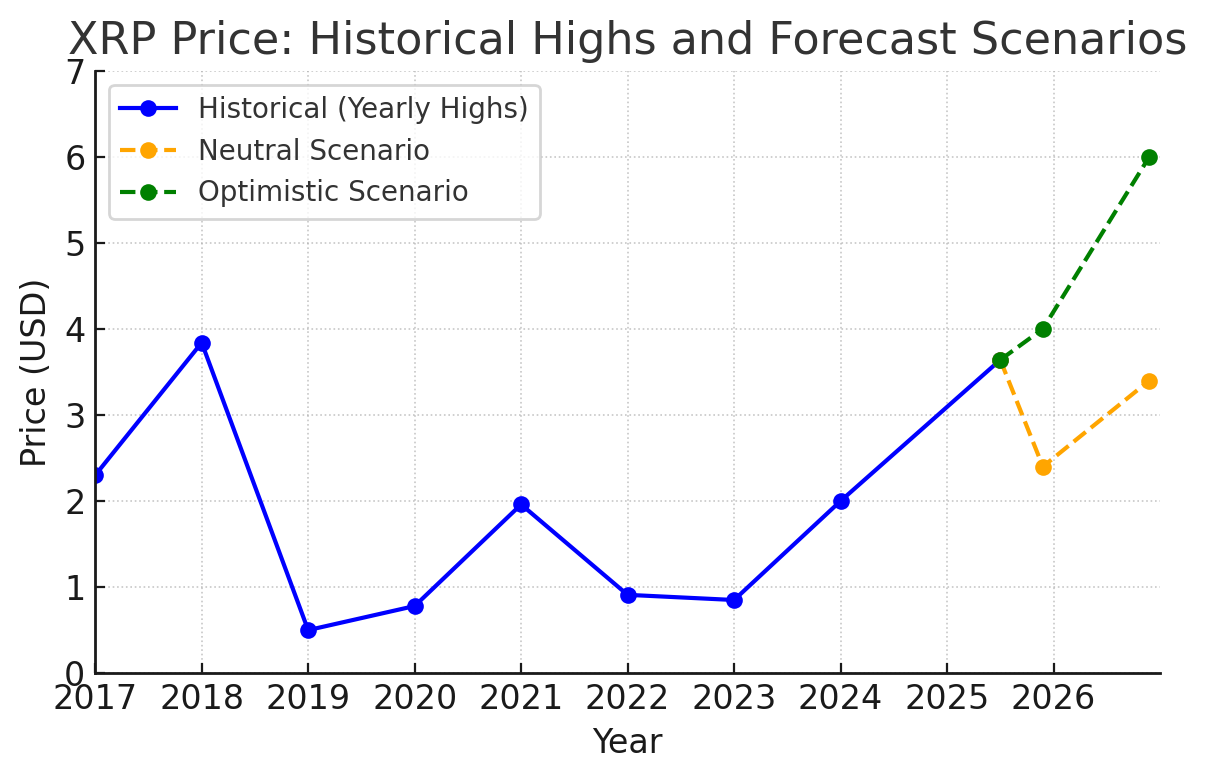

Figure 1 – XRP’s historical price trend (yearly highs) and two forecast scenarios, updated with mid-2025 as a base. The optimistic case envisions XRP approaching $4 by end of 2025 and ~$6 by 2026, whereas a neutral scenario sees more modest growth to around $2.4 by end-2025 and ~$3.4 in 2026. These projections in USD correspond to potential XRP/BTC gains in the bullish case (assuming Bitcoin’s price remains strong). Actual outcomes will depend on adoption, market conditions, and regulatory factors.

Optimistic Predictions for XRP (H2 2025 – 2026 Bullish Outlook)

Many crypto market commentators maintain a bullish outlook on XRP’s future value, citing accelerating adoption and improved sentiment post-regulatory clarity. Several high-profile predictions suggest significant upside by 2026 in USD terms:

- CryptoNews Forecast: Analysts at Cryptonews predict XRP could reach $5.87 by end of 2026 (with a range of $3.53 to $5.87) if the broader market avoids a downturn. They see 2025 ending around $2.35 for XRP – a conservative year-end estimate given the current mid-2025 price ($3.5), implying expectations of a short-term pullback before a strong rally resumes in 2026. This bullish case hinges on growing institutional adoption and pro-crypto regulatory moves (the report notes the supportive stance of the U.S. administration in 2025 as a factor).

- Wall Street Analyst View: According to Cryptopolitan, at least one Wall Street market guru projects XRP could trade between $3.40 and $5.00 by 2026, with $5 as an achievable target. This would mark roughly a 40% gain from current mid-2025 levels (the same prediction was ~70% above earlier mid-2025 prices around $3). Such optimism is underpinned by institutional buying – evidenced by XRP’s 32% weekly price jump in early July 2025 (from $2.27 to $3.01) as large “whale” accounts increased their positions. Indeed, whale wallets are at record highs, signaling that big investors are accumulating XRP. This institutional interest lends credibility to bullish forecasts.

- Economic Times Long-Term Forecast: Crypto analysts cited by The Economic Times posit that XRP’s long-term outlook is increasingly positive. Their mid-term target for late 2025 is $4.00–$4.50, while a 2026–2028 outlook of $6.00–$10.00+ is given, “depending on adoption and regulations.” An analyst from Fundstrat Global Advisors even suggests that if Ripple continues winning institutional use as a bridge currency (e.g. for central bank digital currencies), XRP above $6 in the next bull cycle is not unrealistic. Breaking past the 2021 all-time high (~$3.84) into “uncharted territory” by 2026 is seen as possible in this scenario.

- Other Bold Forecasts: Some crypto influencers outline even more aggressive price trajectories. For instance, one analyst, Capt. “Para8olic” Toblerone, argues XRP could hit $22 by 2026 if the global crypto market cap reaches $35 trillion and XRP captures a proportional $1.2 trillion share. Similarly, veteran Bitcoin investor Davinci Jeremie has floated a $24 target, and Elliott Wave analyst XForceGlobal envisions $10–$40 for XRP “this cycle,” assuming a euphoric altcoin wave. On the extreme end, some enthusiasts like Javon Marks have even predicted $100 XRP (nearly a $6 trillion market cap) by 2025–26. Such outsized forecasts assume unprecedented institutional capital inflows and are widely regarded as highly speculative. Even the more modest bullish targets ($5–$10) would require XRP to attain new record valuations, reflecting a belief that Ripple’s network could play a much larger role in global finance by 2026.

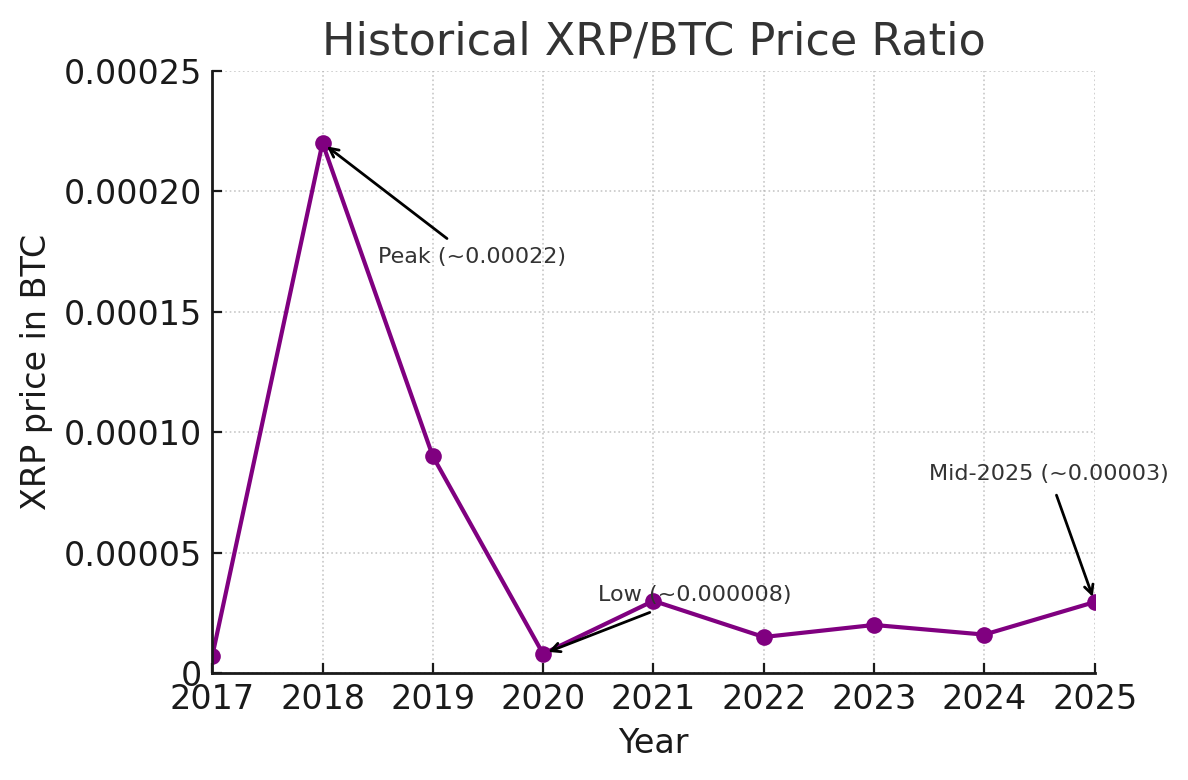

- In BTC Terms: Under these optimistic scenarios, XRP is expected to outperform Bitcoin. For example, a price of ~$6 per XRP in 2026, if Bitcoin holds around $100,000, translates to roughly 0.00006 BTC per XRP – about double the current ~0.00003 BTC/XRP ratio. In effect, bulls foresee XRP gaining market share against Bitcoin. Historical precedent exists: during the 2017 altcoin boom, XRP’s price in BTC terms briefly reached about 0.00022 BTC per XRP (when XRP hit ~$3.30 as Bitcoin traded near $15k). While today’s ratio is much lower, an altcoin-friendly cycle could see XRP/BTC climb back toward multi-year highs. Indeed, some analysts argue that if XRP’s use in payments expands dramatically, its value could decouple to an extent and rise faster than Bitcoin’s during bullish periods.

Figure 2 – Historical XRP-to-Bitcoin (XRP/BTC) price ratio. In early 2018, XRP reached a peak ratio of ~0.00022 BTC during a brief altcoin mania, but it sharply corrected afterward. The ratio hit a low around 0.000008 BTC in 2020 amid legal fears, and has rebounded to ~0.00003 by mid-2025. A neutral outlook sees the ratio stabilizing or gradually rising, whereas an altcoin-friendly cycle could drive XRP to gain ground against BTC – though likely remaining well below the 2018 peak.

Neutral Outlook: Moderate XRP Price Projections

Not all analysts expect explosive growth; some foresee XRP maintaining more gradual or range-bound performance through 2025–2026. These neutral viewpoints highlight that, despite Ripple’s progress, XRP may not drastically outperform the wider crypto market without further catalysts:

- Binance User Consensus: According to a forecast aggregated on Binance’s price prediction page, the community’s consensus for XRP in 2026 is around $3.42. In fact, the user-driven outlook sees XRP near $3.26 by end of 2025 and only slightly higher by 2030 (~$4.16). This implies minimal gains over current prices – essentially a belief that XRP could stabilize in the low-to-mid $3 range (not far from its present ~$3.5 level). In BTC terms, if Bitcoin’s price also stays in a similar band (e.g. $100k–$120k), such a forecast means XRP/BTC would hover around 0.00003 BTC per XRP, roughly maintaining its present relative value. This cautious stance likely reflects uncertainties about whether XRP can substantially increase demand beyond speculative trading.

- Changelly Analysis: A price model published by Changelly similarly projects limited upside in the near term. For 2025, their technical analysis-based prediction estimates XRP averaging ~$2.43 in December 2025 (with a possible range between $1.92 and $2.93). By 2026, Changelly forecasts an average price of about $5.12 (and maximum roughly $5.79). While that nearly doubles XRP’s price from 2025 to 2026, it’s still a conservative climb compared to more bullish targets. Notably, Changelly’s 2025 outlook suggests XRP might end 2025 only around the mid-$2 level – which is actually lower than the current mid-2025 price ($3.5) – implying a potential cooling-off after the current rally. This aligns with the idea that markets could consolidate after an initial post-lawsuit euphoria. The potential ROI by 2026 is +93.6% in their model, a strong gain by traditional asset standards but modest in crypto terms over two years.

- Institutional and Analyst Cautions: Some experts urge tempered expectations due to XRP’s historical volatility and supply dynamics. The Economic Times piece notes that XRP remains one of the more volatile large-cap cryptos, warning that “investors should be ready for sharp corrections on the way up.” Market strategist Tom Bradley emphasizes that even if fundamentals improve, price swings will accompany progress. Additionally, while Ripple’s escrow releases (which gradually increase circulating supply) have been orderly, the large supply of XRP could limit extreme price spikes absent truly massive capital inflows. In a neutral scenario, XRP’s price might largely track the overall crypto market beta – rising or falling roughly in line with Bitcoin and Ethereum rather than decisively outperforming. For instance, if the next couple of years bring a broad but not frenzied crypto uptrend, XRP might slowly appreciate to the $3–$4 range and hold there.

- USD and BTC Perspective: In a moderate case, by end-2026 XRP could be around $3–$4, which – assuming Bitcoin in the $100k neighborhood – equals roughly 0.00003–0.00004 BTC. In other words, XRP’s outlook relative to BTC might be flat to slightly positive. It may neither significantly lag nor dramatically outpace Bitcoin, but rather maintain its share of the crypto market. Indeed, XRP’s share of total crypto market capitalization is about 5% in mid-2025, and a neutral forecast might envision it staying in that single-digit percentage. This would contrast with past peaks (for example, XRP briefly accounted for over 10% of crypto market cap in early 2018). Neutral observers also note that competition in the payments crypto space (from stablecoins, CBDCs, or other networks) could cap XRP’s valuation, keeping its price trajectory modest unless Ripple’s technology achieves breakthrough adoption beyond its current sphere.

Key Drivers: Adoption, Economic Trends & Institutional Commentary

Several fundamental factors will influence whether XRP leans toward the bullish or neutral path. Here we outline key drivers and what experts are saying:

- Surging Adoption and Use-Cases: A core bullish argument for XRP is the growing real-world usage of Ripple’s network for cross-border payments and liquidity. Recent data underscores this trend:

- Transaction Volume on XRPL: The XRP Ledger is seeing record activity. In Q1 2025, the ledger averaged over 2.14 million daily transactions, a massive increase from around 50,000 per day in 2013. Importantly, payments account for nearly 60% of transactions, with weekly payment volumes rising from 1.5 million in 2023 to over 8 million by mid-2025. This indicates that XRP’s utility in moving value is expanding rapidly – a positive sign for long-term value.

- On-Demand Liquidity (ODL) Growth: Ripple’s ODL service, which uses XRP as a bridge currency for remittances and bank transfers, has experienced notable growth. Over $15 billion was transacted via ODL in 2024, a 32% year-over-year increase. Over 300 financial institutions across 45+ countries now use RippleNet, and more than 40% of them are utilizing XRP for ODL in some capacity. This institutional use of XRP in payments provides underlying demand beyond speculation. As one headline put it, SWIFT (the traditional interbank network) is “losing transactions to Ripple” as banks seek faster, cheaper settlement. Ripple’s CEO Brad Garlinghouse recently projected that XRP could handle 14% of SWIFT’s liquidity volume within five years – an ambitious goal that, if even partially realized, would imply trillions of dollars in throughput and potentially justify much higher valuations.

- New Products and Ecosystem Expansion: Ripple is broadening XRP’s use-cases, which could attract more users and investors. In late 2024, Ripple launched a Ripple USD (RLUSD) stablecoin on the XRP Ledger, which quickly gained adoption (over $316M market cap and $100M+ daily volume by early 2025). Additionally, an EVM-compatible sidechain for XRP went live in Q2 2025, enabling Ethereum-compatible smart contracts on the XRP Ledger. This could foster decentralized finance (DeFi) and NFT activity in the XRP ecosystem, increasing utility for the token. These developments support the optimistic case that XRP’s value will grow as the network effect of its usage expands.

- Institutional Commentary and Interest: Another important driver is what major investors and institutions are saying and doing regarding XRP:

- Institutional Accumulation: The mid-2025 rally in XRP has been partly attributed to increased accumulation by institutions and crypto funds. The appearance of large buyers provides credibility to XRP’s investment thesis. For example, Amber Group, a Nasdaq-listed company, announced in 2025 that it added XRP to its $100 million digital asset reserve, joining other firms (Worksport, Wellgistics, etc.) that hold XRP as part of their treasury. Such moves signal confidence in XRP’s long-term viability and can tighten supply available on the market.

- Expert Opinions: Professional analysts have turned more vocal about XRP after the resolution of Ripple’s SEC lawsuit. Marcus Tan of Fundstrat Global Advisors highlighted that if XRP becomes a bridge for central bank stablecoins and international settlements, seeing “XRP above $6 in the next bull cycle” is feasible. James Waldron, an analyst at Messari, noted that XRP’s breakout above $3 in 2025 was “not just technical – it reflects improved investor confidence in Ripple’s enterprise vision,” suggesting that if volume stays strong, “$4.50 is not far off.” These bullish institutional voices focus on XRP’s fundamental story (enterprise adoption, integration into banking), which they believe could drive valuation higher in coming years.

- Cautious Takes: Balanced against that, some institutional analysts urge caution. Crypto legal expert Linda Zhao pointed out that evolving U.S. regulatory support (such as pro-crypto legislation and state-level initiatives) provides a “structural tailwind” for XRP. However, this is conditional; any negative regulatory shock could quickly sour sentiment. And while praising XRP’s current momentum, market strategist Tom Bradley warned that volatility is inherent – “It’s showing strength now, but… be ready for sharp corrections.” Such commentary suggests that even optimistic institutions expect a bumpy road upward. Investors might need patience through possible retracements, especially since crypto markets can overreact to news.

Regulatory Developments and XRP’s Legal Landscape

One of the biggest overhangs on XRP’s price in recent years was regulatory uncertainty – particularly the U.S. SEC lawsuit filed in 2020 alleging XRP was an unregistered security. The resolution of that case and evolving global regulations form a critical backdrop for any XRP price prediction in 2025–2026:

- SEC Lawsuit Resolution: In March 2025, Ripple Labs settled its lawsuit with the SEC, agreeing to pay a $50 million fine. This settlement, following a partial court victory for Ripple in 2023, effectively ended the legal battle and confirmed that XRP is not a security in the context of secondary market sales. The end of the lawsuit removed a major source of FUD (fear, uncertainty, doubt) that had previously led many exchanges to delist XRP. After the settlement, U.S. trading of XRP became legally clearer, and major exchanges freely list XRP again. The bullish impact was evident: XRP’s price surged ~5% on news of a new pro-crypto SEC Chair appointment in Jan 2025 and rallied further as the case concluded. With the lawsuit “in the rearview mirror,” Ripple’s CEO Brad Garlinghouse noted institutions were “finally seeing (Ripple) with confidence” and returning to partnerships. This new legal clarity is a cornerstone of optimistic forecasts, as it paves the way for more institutional adoption without fear of regulatory reprisals.

- XRP ETF and Investment Vehicles: Regulatory green lights have extended to investment products. On April 9, 2025, the first U.S. XRP Exchange-Traded Fund (ETF) launched – a landmark that brings XRP to traditional stock-market investors’ portfolios. Market odds for further XRP ETF approvals have been high (over 80% on prediction markets). An ETF provides easier access for institutions and retirement accounts to gain exposure to XRP without direct custody of the token, potentially unlocking “a fresh wave of institutional capital.” Similarly, ETPs (exchange-traded products) in Europe and elsewhere could broaden the investor base. The existence of an XRP ETF is a strong vote of confidence by regulators and could steadily increase demand if money flows in, supporting the bullish case into 2026. However, a neutral view might argue that volumes in these products could remain small initially, limiting immediate price impact.

- Global Regulatory Climate: Outside the U.S., frameworks are also becoming clearer. In Europe, the MiCA regulations (Markets in Crypto-Assets) set to take effect by 2024–2025 establish formal rules for crypto assets which should benefit legitimate projects like XRP. Japan has long been friendly to XRP – in fact, the CEO of SBI (a major Japanese financial firm and Ripple partner) announced that Japanese banks will begin using XRP for transactions by 2025. Such institutional usage in Japan and across Asia underscores regulatory comfort with XRP as a cross-border tool. Additionally, countries like the UAE and Singapore have been proactive in licensing Ripple’s services, potentially expanding XRP’s global footprint. By 2026, if more banks and fintech companies can use XRP under compliant frameworks, it strengthens the fundamental value proposition.

- Political Shifts in the U.S.: The change in U.S. administration in early 2025 brought a more crypto-friendly tone, which has bolstered sentiment. President Trump’s administration appointed figures seen as open-minded about crypto (e.g. an acting SEC Chair supportive of Web3 innovation). Congress has also been considering legislation to clarify digital asset classifications. For example, bipartisan bills to define when a token is not a security or to regulate stablecoins could further legitimize assets like XRP. The Economic Times noted that “Congress pushing crypto regulation and Ripple’s inclusion in California’s tech initiatives are signs U.S. attitudes are shifting,” giving XRP a “structural tailwind.” All of this implies that the regulatory risk discount on XRP is much lower heading into 2026 than it was a couple of years prior. The neutral scenario assumes no new adverse regulations emerge; the optimistic scenario assumes affirmative regulatory wins (like clear taxonomy laws or central bank endorsements) that could dramatically spur XRP adoption.

- Remaining Risks: It’s important to acknowledge that regulatory hurdles aren’t completely gone. Government agencies worldwide are still developing their approach to crypto. Any unexpected restriction on XRP’s usage (for instance, if a country were to limit bank use of public cryptos in favor of its own CBDC, or if a new lawsuit emerged) could dampen prices. Tax treatment of crypto gains is another factor – harsh tax policy can reduce trading enthusiasm. While these are not expected given current trends, a prudent outlook keeps such risk factors in mind.

XRP vs Bitcoin: XRP-to-BTC Relative Outlook

How might XRP perform relative to the original cryptocurrency, Bitcoin, over the next 18 months? This question is crucial for crypto portfolio allocation, especially as some investors measure success in BTC terms. Historically, XRP’s beta (volatility relative to BTC) has been high – it has seen periods of dramatic outperformance and underperformance against Bitcoin.

Historical Performance

During the late 2017 crypto boom, XRP vastly outpaced Bitcoin for a brief period. XRP’s price in BTC terms spiked to around 0.0002 BTC (i.e., one XRP was worth 1/5000th of a BTC) at its peak in early 2018. At that point, XRP’s market cap nearly overtook Ethereum’s, and Ripple’s token briefly became the #2 crypto globally. However, this was followed by a sharp mean reversion. By the end of 2019, XRP/BTC had fallen to roughly 0.00003 BTC, and by late 2020 it hit an all-time low around 0.000008 BTC amid the SEC lawsuit panic (at that low, one XRP was worth less than 1/100,000th of a BTC). Since then, recovery has been uneven. In the 2021 bull run, XRP did rise in BTC terms (peaking near 0.00003 BTC again in April 2021 when XRP hit ~$1.96), but it lagged behind Bitcoin and many other altcoins toward 2022. Fast forward to mid-2025: with XRP’s surge to ~$3.55 and Bitcoin around $120k, XRP is about 0.0000295 BTC. This is a notable improvement from the extreme lows, but still a fraction (roughly 1/8th) of its ratio at the 2018 peak.

Outlook – Neutral Case

In a neutral scenario where both Bitcoin and XRP see steady, moderate growth, XRP may neither significantly lag nor lead Bitcoin. If XRP ends up around ~$3–$4 in 2026 and Bitcoin perhaps in the $100k–$150k range (depending on how the post-halving cycle plays out), the XRP/BTC ratio might stay roughly in the 0.00002–0.00004 range. XRP would preserve its share of the total crypto market cap. This would mirror patterns from 2019–2023, where XRP moved largely in tandem with broad market sentiment. It’s worth noting that XRP’s correlation with Bitcoin is often high during market-wide rallies or sell-offs. Thus, under baseline conditions, one shouldn’t expect XRP to break away from Bitcoin’s influence absent a specific catalyst.

Outlook – Optimistic Case

In a bullish altcoin cycle or an XRP-specific breakout, XRP could outpace Bitcoin. Several factors might contribute to XRP gaining on BTC:

- Altcoin Rotation: Typically, after Bitcoin makes big moves, investors rotate profits into altcoins (“altseason”). Given XRP’s relatively large cap and lower unit price, it often attracts attention during these periods. A scenario where Bitcoin stabilizes and enthusiasm spills into major alts could see XRP/BTC push higher.

- Specific Adoption News: If, for example, a major central bank or payment company announced heavy usage of XRP, it might drive XRP’s price independently upward. Bitcoin, lacking a single company to drive adoption, might not react to such news, allowing XRP to narrow the gap in relative performance.

- ETF vs ETF: Bitcoin will likely have multiple spot ETFs by 2025/26, but if an XRP ETF also garners inflows, the proportional impact on XRP (a smaller market) could be greater. Even a few billion dollars flowing into an XRP fund would represent a larger percentage of XRP’s market cap than the same amount into Bitcoin, potentially boosting XRP’s price relative to BTC.

In an optimistic scenario sketched by experts, XRP at $5–$6 while Bitcoin is ~$100k would mean XRP/BTC of 0.00005–0.00006. That implies XRP roughly doubling its value against Bitcoin compared to mid-2025 levels. It’s bullish, but not unprecedented – XRP traded at those ratios or higher in past cycles (e.g., 2017–18). Still, it would represent a significant shift from recent years.

Risks and BTC Dominance

One caveat to the bullish relative case is the trend in Bitcoin dominance. Bitcoin’s dominance (its percentage of total crypto market cap) is about 60% in mid-2025, relatively high compared to a few years ago. If the crypto market continues to be Bitcoin-led, it might be challenging for XRP to meaningfully boost its BTC-denominated value. Moreover, Bitcoin’s role as digital gold vs. XRP’s role as a payments/token utility means they respond differently to narratives. In times of macro uncertainty, Bitcoin may benefit as a “flight-to-safety” within crypto, whereas utility tokens like XRP could be seen as riskier. On the other hand, in times of froth and speculative excess, XRP historically has seen huge spikes against BTC. Therefore, investors should be aware that XRP/BTC can be very volatile. The ratio could whipsaw in either direction depending on seasonality and news. Prudent analysis suggests not to chase XRP solely to outperform Bitcoin – rather, consider that owning XRP is a bet on Ripple’s network growth in addition to general crypto market growth.

Conclusion: Navigating XRP’s Future with Cautious Optimism

XRP’s price trajectory in H2 2025 and through 2026 will likely be shaped by a tug-of-war between transformative potential and pragmatic reality. On one hand, the bullish factors are substantial – Ripple’s network is growing, major legal hurdles have cleared, and expert forecasts see XRP pushing toward new highs if adoption accelerates. It’s conceivable that by the end of 2026, XRP could trade in the mid-single digits (or higher under ideal conditions), especially if the crypto market as a whole enters a strong upcycle. On the other hand, the neutral scenarios remind us that markets often “price in” good news well in advance. XRP’s roughly 500% gain in late 2024 and early 2025 (from ~$0.50 to over $3) has in many ways preempted the positive developments. From here, consolidation or moderate growth might be the base case absent fresh catalysts – meaning today’s price levels around $3–$4 could persist for some time if enthusiasm cools.

Both optimistic and neutral viewpoints agree on one thing: XRP’s performance will depend on continued fundamental progress – real-world usage, partnership growth, and regulatory clarity. Investors and analysts will be watching metrics like transaction volumes, ODL flows, and institutional adoption closely. They will also watch the macro environment: a booming economy with ample risk appetite could lift XRP further, while a risk-off climate or crypto-specific setbacks could restrain it. Price forecasts for XRP in 2025–2026 range widely – from around $3 in the cautious camp up to $6 or more in bullish circles, with a few outliers dreaming of double-digit prices. In BTC terms, XRP could either hold its ground or potentially double its value against Bitcoin in a best-case scenario.

Ultimately, XRP occupies a unique space as both a top-tier cryptocurrency and a fintech utility token. This dual nature means its price can be influenced by both general market moods and Ripple-specific news. For readers and investors, the key is to stay informed and avoid over-exuberance or undue pessimism based on any single prediction. Navigating XRP’s future calls for cautious optimism – acknowledging the exciting upside potential while remaining grounded in the realities of market volatility and gradual adoption curves.

Disclaimer: Cryptocurrency investments are highly volatile and speculative. Prices can fluctuate rapidly, and past performance is not indicative of future results. This content is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider your financial situation and risk tolerance before investing. Never invest more than you can afford to lose.